Inflation has been one of the most defining economic stories of the past four years in Australia. What began as a gradual post-pandemic uptick in prices turned into the steepest inflationary climb in decades, prompting aggressive policy tightening and reshaping how households and businesses manage their finances.

Between 2021 and 2025, the country saw inflation soar, then stabilise, but not without lasting effects. Here’s how that journey unfolded, and what it means for the years ahead.

The Peak of the Surge: 2021 to Late 2022

Inflation began climbing steadily in late 2021, driven by pandemic-related supply chain disruptions, surging global fuel prices, and strong domestic demand as lockdowns ended. Initially, policymakers expected it to be temporary. But as shortages persisted and energy costs rose, inflation accelerated rapidly.

By December 2022, the Australian Bureau of Statistics (ABS) reported headline inflation at 8.4%, the highest level in more than thirty years. The RBA’s long-standing 2–3% target range had been completely eclipsed.

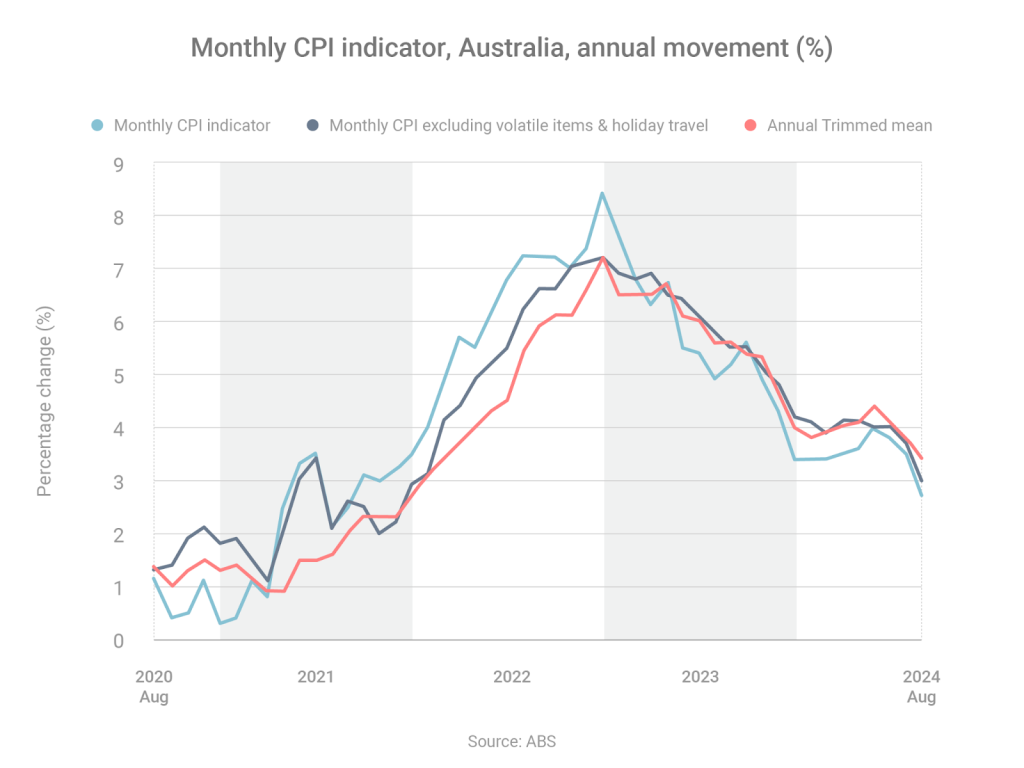

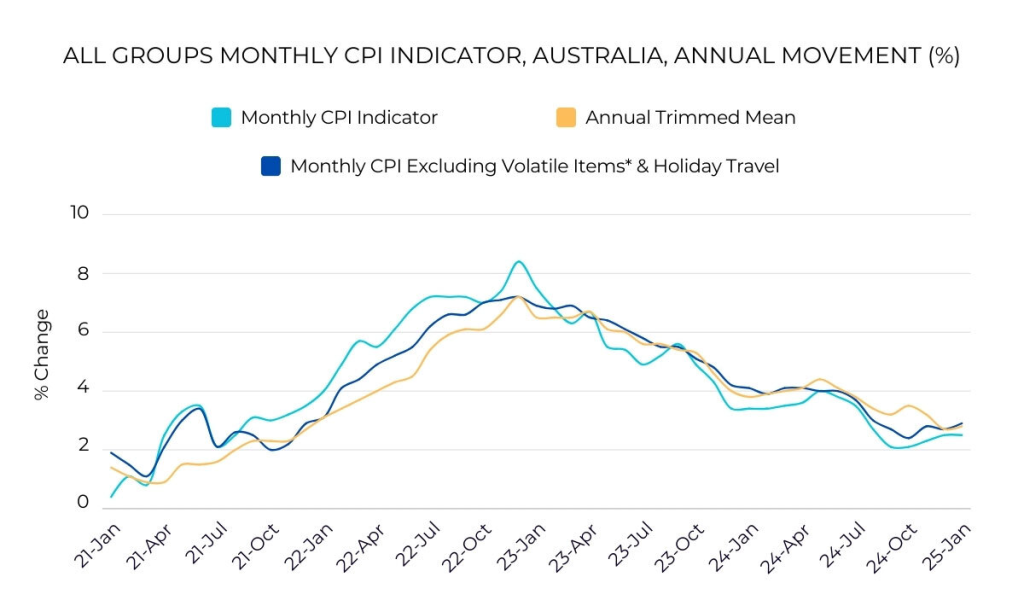

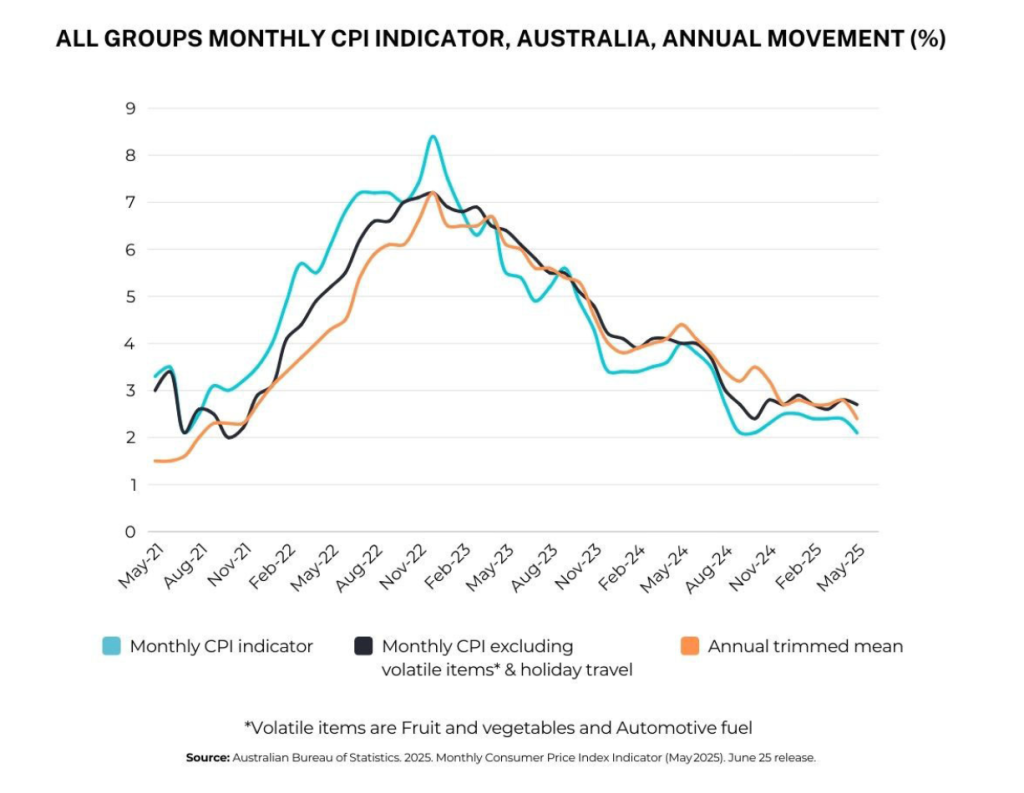

This chart highlights the sharp rise across headline and underlying CPI measures through 2022, illustrating the magnitude of the inflationary spike.

The Monetary Response and Slowing Momentum

To combat soaring prices, the Reserve Bank of Australia began raising the cash rate aggressively throughout 2022 and 2023. What started as cautious quarter-point increases soon became a determined campaign to curb inflation and rein in demand.

The higher rates quickly rippled through the economy. Households with variable mortgages faced steep repayment increases, while businesses delayed investment decisions. As demand softened, inflation began a slow and steady descent.

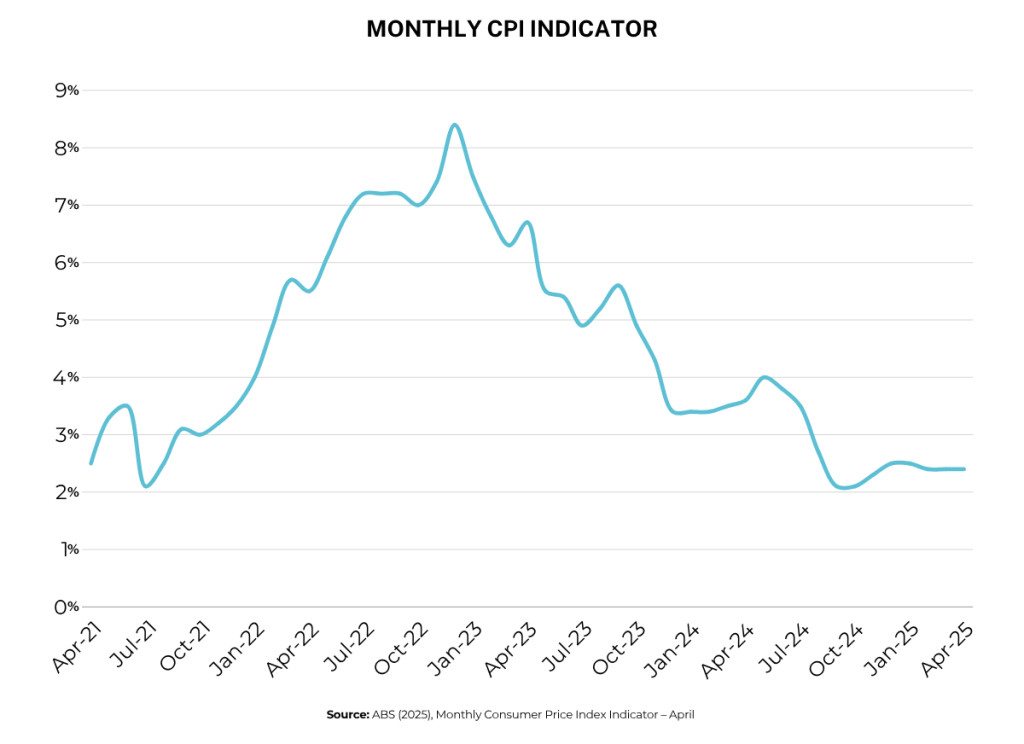

The Monthly CPI Indicator shows how inflation peaked in 2022 and then declined gradually through 2023 and 2024 as higher interest rates took effect.

The RBA’s preferred measure, trimmed mean inflation, also began to moderate, suggesting that even core prices, not just volatile components, were cooling.

Trimmed mean data confirms that underlying inflationary pressures eased significantly during the period, aligning with headline improvements.

Early 2025: Stability with Caveats

By early 2025, inflation had remained within the RBA’s 2–3% band for nine consecutive months. The headline CPI sat at 2.4%, while the trimmed mean recorded 2.8% – a welcome development after years of volatility.

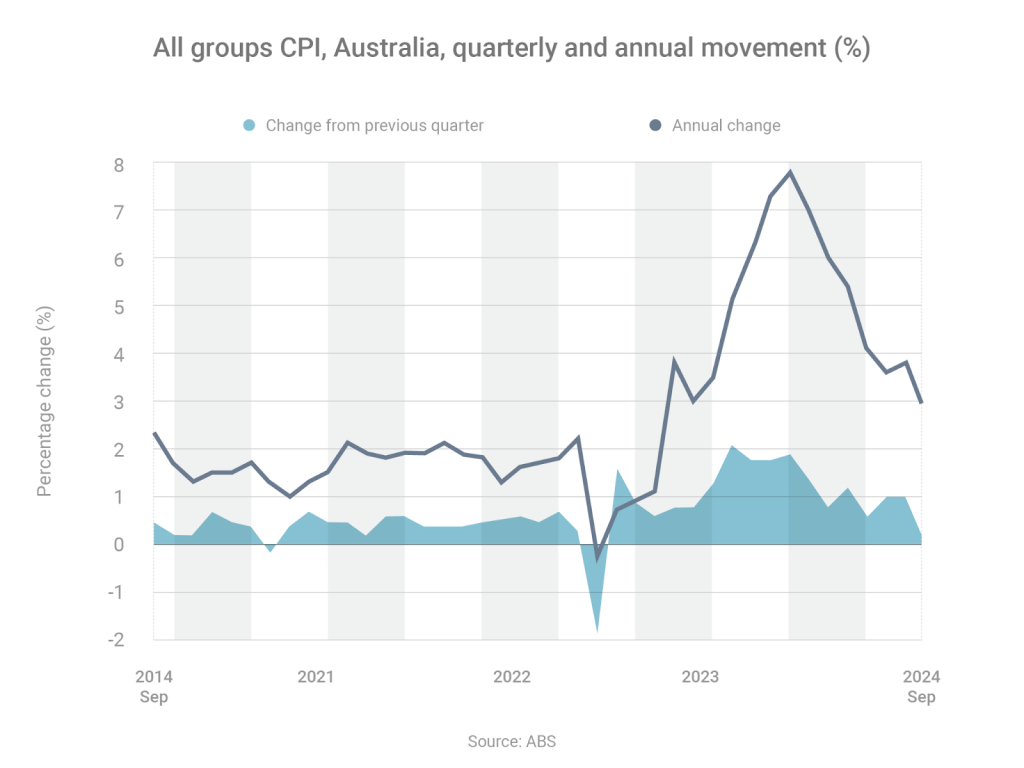

Quarterly CPI results reflected this stabilisation, showing smaller, more consistent price movements compared to earlier years.

Despite this progress, the RBA remained cautious. At its May 2025 meeting, the board described “welcome progress” but warned that upside risks remained. The most immediate concern was the scheduled expiry of federal energy rebates, which had been artificially holding down power costs. Their removal could temporarily lift inflation again in late 2025.

The labour market was another key factor. Unemployment remained at 4.1%, and job vacancies were still high, leading to persistent wage growth. The RBA worried that these conditions could keep inflation sticky, particularly in service sectors where labour accounts for a large share of costs.

Trimmed mean inflation, the RBA’s core gauge, remained slightly elevated, reinforcing the case for maintaining a restrictive stance on interest rates.

A Decade in Perspective

Zooming out, the inflation cycle of 2021–2025 stands out as one of the most dramatic in modern Australian history. For much of the 2010s, inflation hovered comfortably between 1.5% and 2.5%. The sudden jump to more than 8% in 2022 shattered that stability and tested the limits of monetary policy.

This long-term chart from 2014 to 2025 underscores how exceptional the inflationary spike was, and how gradually the return to stability has unfolded.

The Business Reality: Costs Remain Elevated

Although inflation has cooled, the aftershocks are still being felt. Electricity, insurance, labour, and logistics costs remain well above pre-pandemic levels. Many small and medium-sized businesses are finding that even with price stability, the new normal is more expensive.

The CPI’s plateau within the target band shows that while inflation growth has slowed, absolute prices remain high, keeping pressure on margins.

For many businesses, this environment demands a strategic approach to cost control and capital efficiency. Some have focused on renegotiating supplier contracts or investing in automation to improve productivity. Others are finding that financial restructuring can deliver faster relief.

Practical Strategies for Managing Ongoing Cost Pressures

While the worst of inflation may be over, managing its lingering effects requires planning and adaptability. Businesses can strengthen their financial footing by:

- Reviewing existing finance arrangements. Refinancing older, higher-interest loans could free up cash flow and reduce monthly expenses.

- Reassessing energy and service contracts. As competition increases, better-value deals are becoming available.

- Investing in efficiency gains. Upgrading equipment or automating repetitive tasks can help offset higher wage costs over time.

To cope with rising operating expenses, even small financial improvements can have outsized benefits. If your business is paying more interest than necessary, refinancing could provide breathing room to reinvest in operations or growth.

If you’d like assistance reviewing your business or commercial property loans to explore better lending options, our team can help identify where meaningful savings can be made. Contact Peel Finance Brokers today!

Related posts:

- The Future of Electronic Payments

- Implications of Rising Interest Rates for Western Australian Households

- What Does 2023 Hold for Brokers and Their Clients?

Dip. of Management (Deacon University)

Dip. of Finance/Mortgage Broking Mgt.

Assoc. Cert. of Business (Real Estate)

Assoc. of Mort. Ind. Assoc. of Aust. (AMIAA)

Terry Boag is the founder and CEO of Peel Finance Brokers and has been providing professional and loyal service to the Mandurah and southwest area for 25 years. With a long history of financial experience, Terry is reliable and dedicated to his clients, always ensuring the highest customer service and delivering strong lender relationships.