After years of rapid price growth, the property market is showing early signs of cooling, and that’s opening up new opportunities for buyers. According to Cotality data, 94.3% of vendors sold their homes for more than they originally paid in the March 2024 quarter, the highest result since 2010.

However, the report also shows a shift in momentum in 2025, as sales volumes ease and days on market increase. For buyers, this creates the chance to negotiate better deals and enter the market strategically.

Vendors Are Still Achieving Strong Profits

CoreLogic’s data highlights just how profitable property ownership has been:

- 97.1% of house owners made a profit compared to 89% of unit owners

- Median profits vary significantly by ownership period:

- Up to 2 years: $82,000

- Up to 10 years: $275,000

- Up to 20 years: $435,000

- Up to 30 years: $780,000

This shows that while vendors are still enjoying strong returns, the balance of power is starting to shift.

Sales Volumes Are Falling & Buyers Are Gaining Leverage

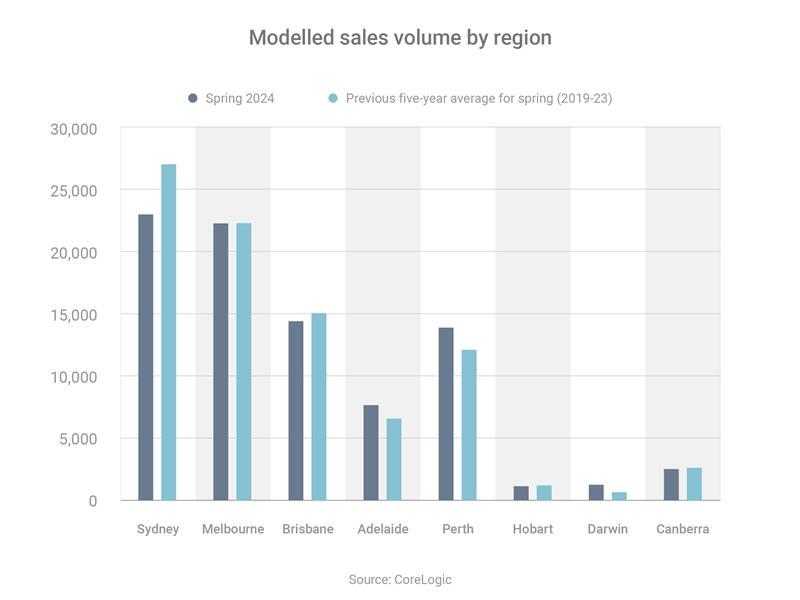

While profits remain healthy, Cotality reports that national property sales volumes were 4% lower during the 2024 spring season compared to the five-year average.

At the same time:

- The average days on market increased from 28 to 32 days between August and November 2024

- Buyers are now seeing less competition at auctions and private sales

- Vendors are being pushed to price more realistically

This combination of slower sales and longer selling times means buyers heading into 2025 have more negotiating power than they’ve had in years.

How to Prepare Before Making Your Move

With conditions shifting, smart preparation is key. Here’s what we recommend:

- Boost your savings to strengthen your deposit

- Avoid unnecessary big-ticket purchases to keep your financial profile strong

- Improve your credit score by paying bills on time

- Maintain employment stability since lenders favour consistent income

- Secure pre-approval for your home loan to act quickly when the right property appears

Whether you’re a first-home buyer, upgrading your home, or investing, our team at Peel Finance Brokers can guide you through the shifting market. We’ll assess your borrowing power, structure your loan strategically, and help you negotiate the best possible deal. Get in touch today to find out how we can position you for success in 2025’s changing property market.

Related posts:

- Reasons to Invest in the Australian Real Estate Market

- The Evolving Mortgage Landscape in Western Australia

- The Rising Burden of Stamp Duty: A Modern Australian Dilemma

Dip. of Management (Deacon University)

Dip. of Finance/Mortgage Broking Mgt.

Assoc. Cert. of Business (Real Estate)

Assoc. of Mort. Ind. Assoc. of Aust. (AMIAA)

Terry Boag is the founder and CEO of Peel Finance Brokers and has been providing professional and loyal service to the Mandurah and southwest area for 25 years. With a long history of financial experience, Terry is reliable and dedicated to his clients, always ensuring the highest customer service and delivering strong lender relationships.