Breaking into the property market can feel overwhelming, but there’s good news for first-home buyers, single parents, and regional buyers. With the federal government’s expanded Home Guarantee Scheme (HGS) and a range of state-based grants, home ownership in 2025 is now more achievable than ever.

This guide breaks down how the HGS works, the incentives available across each state, and the property price caps you need to know before you start house hunting.

What Is the Home Guarantee Scheme?

The Home Guarantee Scheme (HGS) is a federal initiative designed to help eligible Australians purchase a home sooner, without needing a large deposit or paying costly lender’s mortgage insurance (LMI).

For the 2025–26 financial year, the government has released 50,000 new scheme places across three key programmes:

- 35,000 places under the First Home Guarantee – for first-home buyers or those who haven’t owned a home in the past 10 years.

- 10,000 places under the Regional First Home Buyer Guarantee – tailored to regional buyers purchasing property in eligible areas.

- 5,000 places under the Family Home Guarantee – for single parents and single legal guardians purchasing with just a 2% deposit.

These programmes allow buyers to secure a home with as little as 5% deposit, or 2% for single parents, while avoiding LMI, which can save you tens of thousands of dollars upfront.

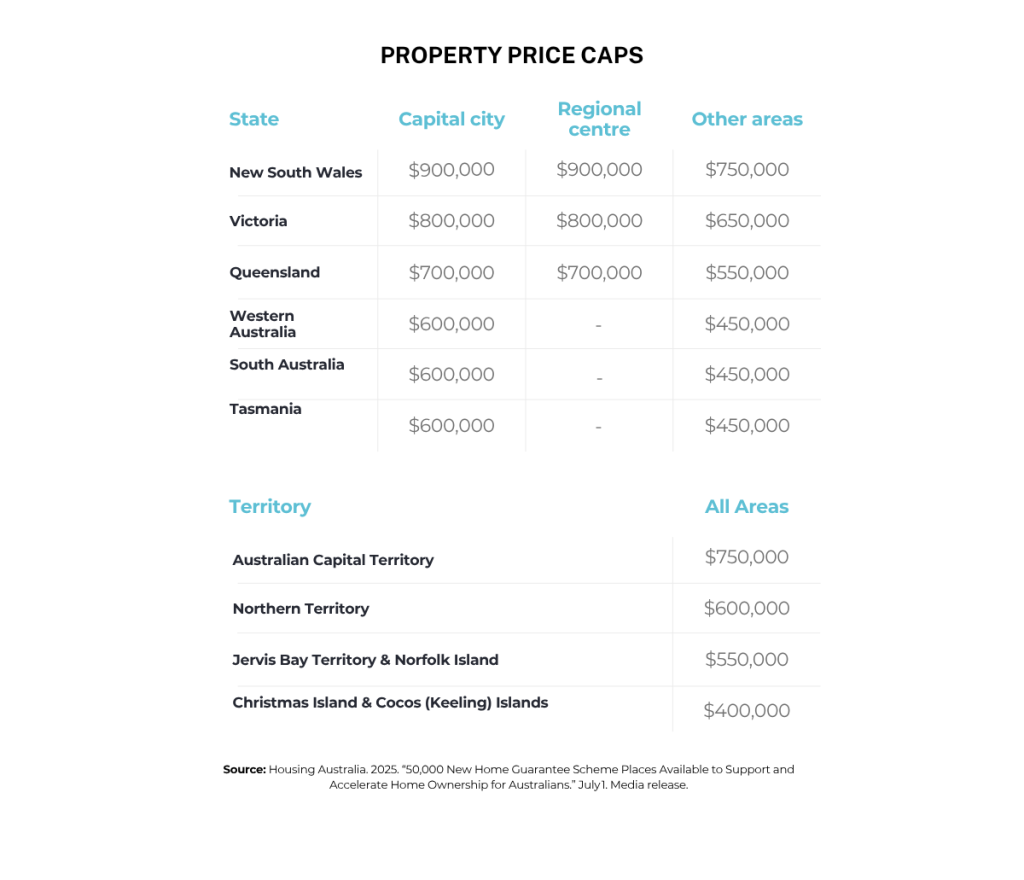

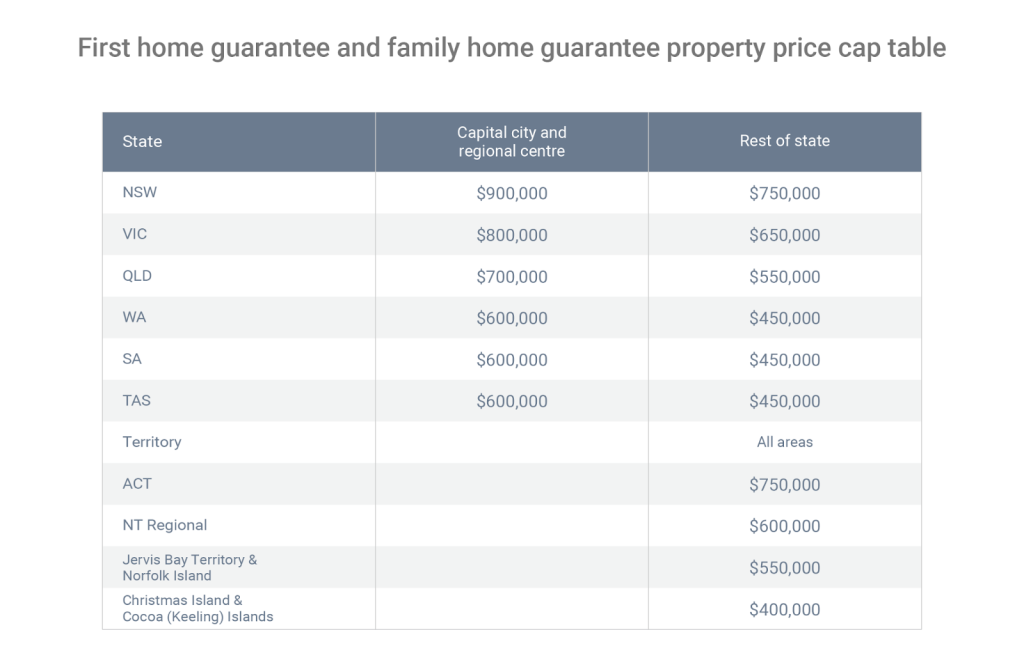

Property Price Caps for 2025

To qualify for the HGS, your property must fall under the maximum price caps set by state and region. These limits ensure the programme supports buyers entering the market, rather than high-end property purchases.

For example:

- Western Australia: $600,000 in Perth and $450,000 in other areas.

- Queensland: $700,000 in Brisbane and $550,000 in regional areas.

- Victoria: $800,000 in Melbourne and $650,000 in regional locations.

- New South Wales: Up to $900,000 in Sydney and $750,000 elsewhere.

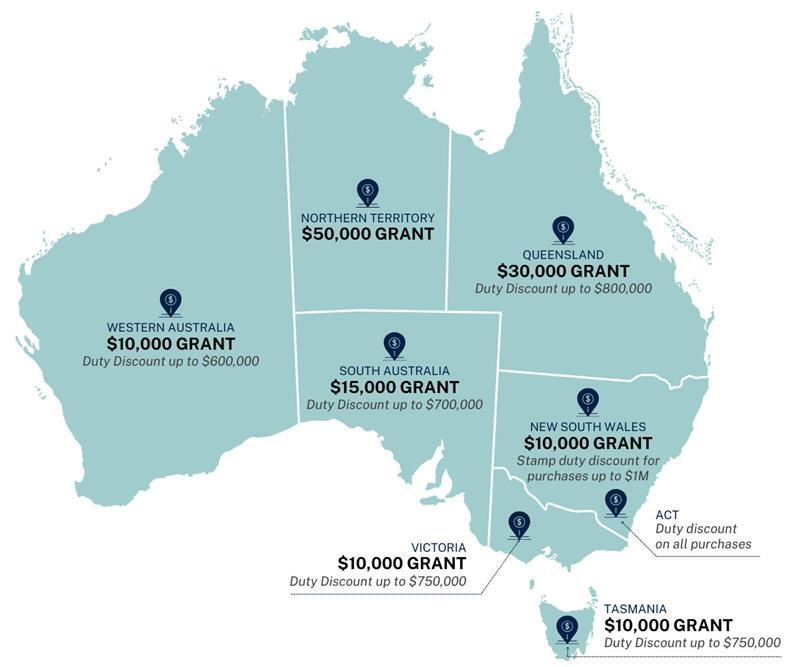

State-Based First Home Buyer Grants and Incentives

Alongside the HGS, each state and territory offers its own grants and stamp duty concessions to help first-home buyers get started:

- New South Wales – $10,000 grant + stamp duty discounts up to $1M

- Victoria – $10,000 grant + duty discounts up to $750,000

- Queensland – $30,000 grant + duty discounts up to $800,000

- Western Australia – $10,000 grant + duty discounts up to $600,000

- South Australia – $15,000 grant + duty discounts up to $700,000

- Tasmania – $10,000 grant + duty discounts up to $750,000

- ACT – duty discounts on all purchases

- Northern Territory – $50,000 grant

What’s New in 2025: Help to Buy Scheme

Expected to launch later this year, the Help to Buy programme is another major initiative designed to reduce the financial burden of buying a property. It’s a shared-equity scheme, where the government contributes up to 40% of the purchase price in exchange for an ownership stake.

This means eligible buyers may only need to fund 60% of the property cost themselves, a huge boost for affordability.

Who’s Eligible?

To access the HGS or other grants, you’ll need to meet the following criteria:

- Be an Australian citizen or permanent resident.

- Intend to live in the property as an owner-occupier.

- Meet the income limits:

- $125,000 for single applicants

- $200,000 for joint applicants

- Purchase within the relevant property price caps for your area.

How Peel Finance Brokers Can Help

The Home Guarantee Scheme and related grants open new opportunities for buyers, but understanding eligibility rules, property caps, and lender requirements can be complex. That’s where we come in.

At Peel Finance Brokers, we’ll:

- Assess your eligibility for grants and schemes.

- Compare lending options from participating banks.

- Guide you through your home loan application.

- Help you structure your deposit and borrowing strategy.

With tailored advice and access to multiple lenders, we make the process simpler and faster, so you can focus on finding your dream home.

Contact Peel Finance Brokers today to find out if you qualify for the Home Guarantee Scheme, state-based grants, or shared-equity programmes.

Related posts:

- Home Loan in Australia – Current Market Update (2022)

- How a Mortgage Broker Can Help You Secure a Home Loan

- Rising Investor Interest and Falling High-Debt Borrowing in Australia

Dip. of Management (Deacon University)

Dip. of Finance/Mortgage Broking Mgt.

Assoc. Cert. of Business (Real Estate)

Assoc. of Mort. Ind. Assoc. of Aust. (AMIAA)

Terry Boag is the founder and CEO of Peel Finance Brokers and has been providing professional and loyal service to the Mandurah and southwest area for 25 years. With a long history of financial experience, Terry is reliable and dedicated to his clients, always ensuring the highest customer service and delivering strong lender relationships.