Investor sentiment has been rebuilding through 2024 and 2025. Lending data shows more investors stepping in than stepping out, while rents remain high even as growth cools. Put together, the market is entering a phase that rewards preparation over speculation. If you have been weighing up an investment purchase, the conditions now favour well-researched, finance-ready buyers.

What’s Really Changing

Two shifts stand out. First, participation is rising. New investor loan commitments are running above the recent average, and investors made up about 37.7% of new lending in the June quarter. Listings by investors remain below their 2021 peak, which suggests many are holding assets rather than exiting. That is a sign of confidence in long-term capital growth and the value of rental income to help service debt.

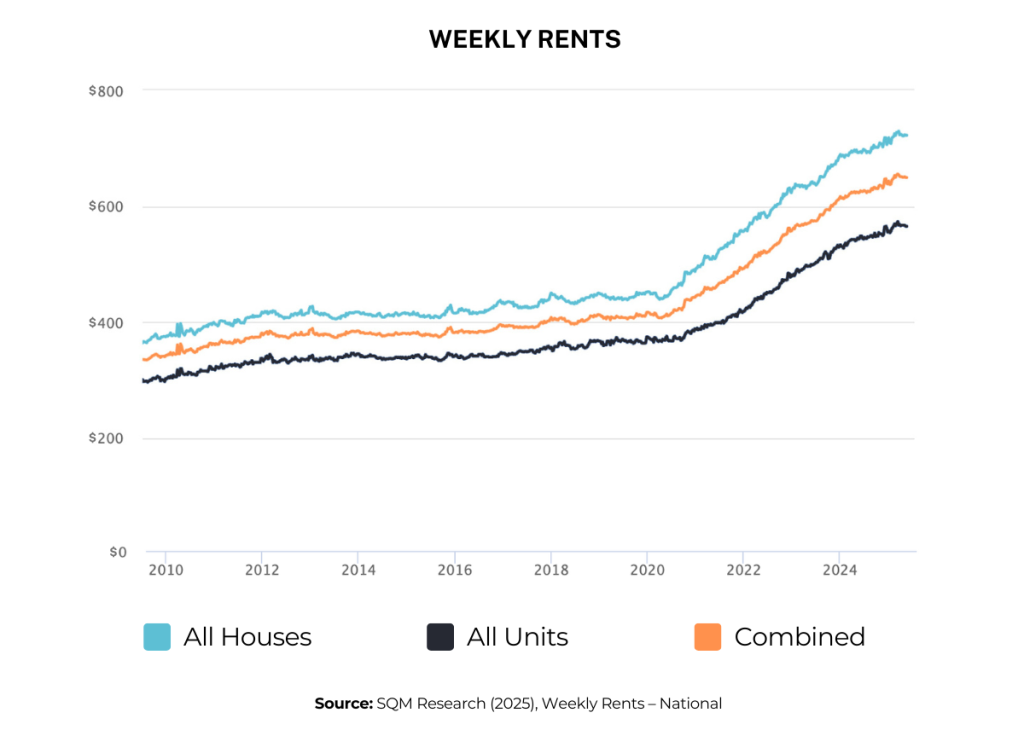

Second, rents have moved to a steadier gear. The national median rent reached a record high by the end of 2024, yet quarterly growth slowed to the weakest pace since 2021. For investors, that combination is useful. Income levels are elevated, while the heat that made leasing tricky for some tenants is easing. It supports more realistic yield forecasts and fewer surprises at renewal time.

How to Read the Opportunity

The opportunity is not about chasing quick gains. It is about selecting assets that can hold value through cycles and produce dependable cash flow. Three practical implications follow:

- Use current rent levels, not last year’s spikes. When you estimate yield, base assumptions on today’s achieved rents and allow for a slower growth path. This keeps cash flow conservative and avoids over-promising in applications.

- Expect more balance in negotiation. With investor activity up but not overheated, well-priced properties attract interest without runaway bidding. Buyers who arrive with clean documentation and a clear finance pathway often win on certainty in addition to price.

- Watch policy settings. The temporary ban on foreign purchases of established dwellings (April 2025 to March 2027) and stronger compliance on land banking tilt more stock and attention toward local buyers. This can improve choice in some pockets and reduce left-field competition.

Framework to Test a Purchase

Keep the analysis simple and disciplined.

Serviceability Check

Model repayments at your quoted rate and include a stress buffer. Confirm headroom if rates lift or if the property is vacant for short periods.

Yield & Cash Flow

Use current rent evidence. Add realistic allowances for management, maintenance and insurance. Aim for a cash flow that can absorb small shocks.

Equity & Risk

Make sure the deposit source and LVR align with your comfort level and lender policy. If you plan interest-only, have a view on the principal strategy later.

If the numbers are tight, revisit suburb selection, property type or value-add options rather than forcing the deal.

Loan Structures That Support the Plan

The finance structure is as important as the property choice.

- Investment home loans: Compare fixed and variable options with a focus on cash flow, offset access and repayment flexibility.

- Interest-only periods: Useful for cash flow through the first years. Pair with a plan for principal reduction or equity growth milestones.

- Equity release: Homeowners can use existing equity to fund deposits and costs. Run conservative valuations and build in buffers for settlement timing.

- Refinance readiness: If your current loan no longer fits the plan, a refinance can align features and pricing with your investment strategy.

Where This Leaves Buyers Now

The market is not flashing a simple buy or sell signal. It is presenting a window where income is supportive, price growth is measured, and lending is active. That favours investors who arrive prepared, with a clear budget, realistic rent assumptions and a finance structure that protects cash flow.

If you would like a clear view of your borrowing capacity, or want help pressure-testing a shortlist against lender policy and cash-flow scenarios, our team can step through the numbers with you and outline suitable loan options. Contact Peel Finance Brokers to model scenarios, compare lenders and set up a pre-approval that lets you move confidently when the right property appears.

Related posts:

- Navigating the Western Australian Property Market in 2025

- Property Investors Drive Surge in Borrowing: What It Means for You

- Western Australia’s Property Market Thrives Amid High Rates

Dip. of Management (Deacon University)

Dip. of Finance/Mortgage Broking Mgt.

Assoc. Cert. of Business (Real Estate)

Assoc. of Mort. Ind. Assoc. of Aust. (AMIAA)

Terry Boag is the founder and CEO of Peel Finance Brokers and has been providing professional and loyal service to the Mandurah and southwest area for 25 years. With a long history of financial experience, Terry is reliable and dedicated to his clients, always ensuring the highest customer service and delivering strong lender relationships.