Australian business borrowing is rising sharply, but not necessarily for the reasons you’d expect. At a glance, high interest rates, global trade tensions, and persistent inflation might seem like deterrents to commercial lending. But recent data and central bank commentary suggest that many businesses remain surprisingly resilient and strategic.

Borrowing on the Rise

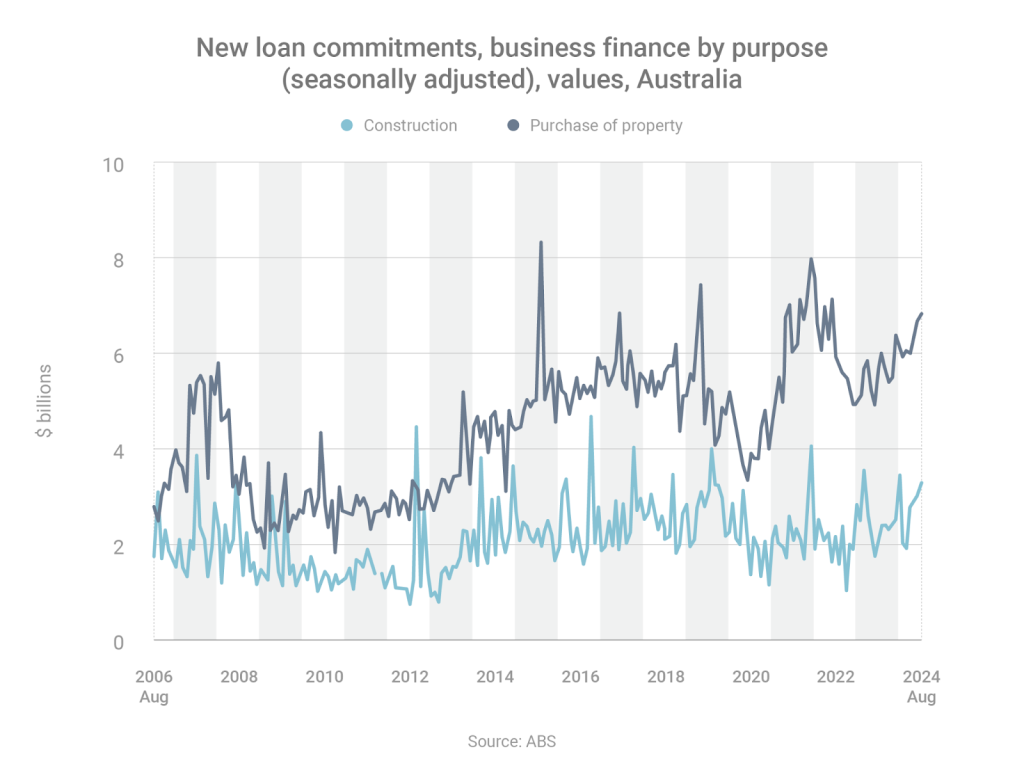

In August 2024, Australian businesses borrowed more than they had in any single month since January 2022, committing over $10 billion in new loans. This included:

- $6.81 billion for property purchases, and

- $3.24 billion for construction, which was up more than 60% year-on-year.

This jump in business borrowing has coincided with a slow but notable recovery in business sentiment. Roy Morgan’s business confidence index rose 8.3% year-on-year in September, showing that nearly 41% of businesses expect to be better off financially within 12 months.

Yet confidence still sits below long-term averages. So why are businesses borrowing more?

Rethinking the Link Between Interest Rates and Borrowing

The Reserve Bank of Australia (RBA) offers a valuable insight here. In its recent Statement on Monetary Policy, the RBA noted that business borrowing doesn’t follow the same rules as home lending. While mortgage activity tends to shrink in high-rate environments, commercial borrowing is driven by a wider set of factors:

- Investment opportunities (like property acquisitions or agri-land)

- Mergers and acquisitions

- Strong cash reserves and low leverage

- Lender appetite to support profitable ventures, even during tightening cycles

Put simply, businesses are borrowing because they can, not just because the rates are favourable.

This suggests that many firms, especially those with sound balance sheets, are seeing beyond the rate cycle, focusing instead on long-term growth or strategic positioning.

Tariffs and Trade: Risks Still on the Horizon

At the same time, global economic conditions are throwing up fresh challenges. Trade tensions between the US and its partners have raised concerns about supply chain costs, compliance red tape, and currency volatility. According to PwC, tariffs imposed by the US may affect Australian exporters, even if Australia has avoided direct penalty increases.

However, it’s not all bad news. If US tariffs continue to target other countries more harshly than Australia, there may be a window of opportunity for Australian-made goods to fill the gap. Under the Australia-US Free Trade Agreement (AUSFTA), local exporters could become more competitive in American markets due to lower duties.

This could explain part of the borrowing activity we’re seeing: forward-looking businesses are investing now to meet future demand, before supply chain conditions potentially worsen.

What It Means for You

For business owners, the current environment is a balancing act. Cost pressures are real, but so are growth opportunities, particularly in property, construction, and international markets.

That’s why many well-prepared businesses are reviewing their financing now, even as economic signals remain mixed. If you haven’t reassessed your commercial lending structure recently, now could be a smart time to act.

Peel Finance Brokers can help you explore options for refinancing outdated loans, unlocking equity for expansion, structuring finance around your cash flow, preparing your business for international trade growth, and more. Contact us today to book a finance review and put your business in the strongest possible position.

Related posts:

- Business Failures Are Rising Across Australia

- Navigating Business Financing Options During Economic Downturns in Western Australia

- High-Risk Sectors, ATO Crackdowns & Cash Flow Pressure: What WA Businesses Need to Know

Dip. of Management (Deacon University)

Dip. of Finance/Mortgage Broking Mgt.

Assoc. Cert. of Business (Real Estate)

Assoc. of Mort. Ind. Assoc. of Aust. (AMIAA)

Terry Boag is the founder and CEO of Peel Finance Brokers and has been providing professional and loyal service to the Mandurah and southwest area for 25 years. With a long history of financial experience, Terry is reliable and dedicated to his clients, always ensuring the highest customer service and delivering strong lender relationships.