Australia’s property investment market heated up in 2024, with data from the Australian Bureau of Statistics (ABS) and Cotality revealing significant shifts in investor activity and lending trends. For buyers, this means opportunities are growing, but so is the competition.

Investor Borrowing Hit Record Highs

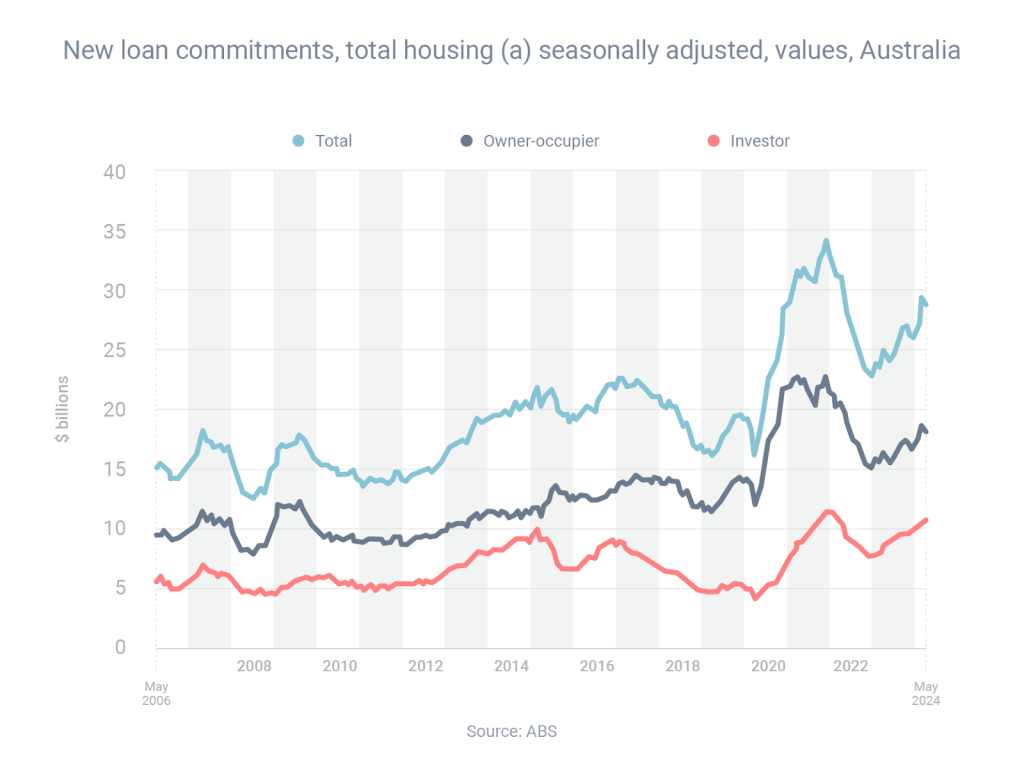

Property investors are increasingly active, committing $11.71 billion in July 2024, a 35.4% increase compared to July 2023, the second-highest month on record.

This surge signals renewed confidence in property as a wealth-building strategy and highlights the need for tailored financing solutions.

Key Trends in Home Loan Activity

The ABS data shows that investors aren’t the only ones borrowing more. Owner-occupier loans also rose 12.2% year-on-year, reaching $18.13 billion in May 2024.

Overall, investors made up 37.1% of all home loans issued in May, slightly above the long-term average of 35.9%.

This trend reflects a broader shift: investors are re-entering the market aggressively, while many first-home buyers are still cautious due to affordability pressures.

Why So Many Australians Are Turning to Property Investment

An analysis by Cotality’s head of research, Eliza Owen, shows the number of investors entering the market is outpacing the number exiting.

“Investor inferred listings have been trending higher since March this year, to 13,000, but remain well below the peak of investor listings activity in November 2021,” says Owen.

With 18,400 new investor loan commitments, compared to the five-year monthly average of 14,516, property investing remains highly attractive due to:

- Capital growth – potential for significant property value increases

- Rental income – steady returns to offset mortgage costs

- Tax benefits – deductions on negatively geared properties

- Portfolio diversification – balancing shares and other assets

- Equity leverage – using built-up equity to expand your portfolio

What This Means for Buyers and Investors

With increased investor demand, competition for quality properties is intensifying. However, there are still strong opportunities, particularly if you have a clear financing strategy and understand your borrowing power.

Here’s how you can prepare:

- Reduce your spending to improve your serviceability

- Pay all bills on time to strengthen your credit score

- Maintain stable employment to increase loan approval chances

- Seek professional loan advice to compare lenders and secure better terms

How Peel Finance Brokers Can Help

At Peel Finance Brokers, we simplify the lending process by:

- Comparing the entire market to find the right lender and product

- Structuring your loan strategically to maximise borrowing potential

- Managing your application from start to finish for a stress-free experience

- Modelling different investment scenarios so you can make confident decisions

Call us today to book your free consultation and get personalised loan advice tailored to your goals.

Related posts:

- Western Australia’s Property Market Thrives Amid High Rates

- Why It Pays to Shop Around for a Home Loan in 2025

- The State of the Rental Market and How it Affects Your Borrowing Capacity

Dip. of Management (Deacon University)

Dip. of Finance/Mortgage Broking Mgt.

Assoc. Cert. of Business (Real Estate)

Assoc. of Mort. Ind. Assoc. of Aust. (AMIAA)

Terry Boag is the founder and CEO of Peel Finance Brokers and has been providing professional and loyal service to the Mandurah and southwest area for 25 years. With a long history of financial experience, Terry is reliable and dedicated to his clients, always ensuring the highest customer service and delivering strong lender relationships.